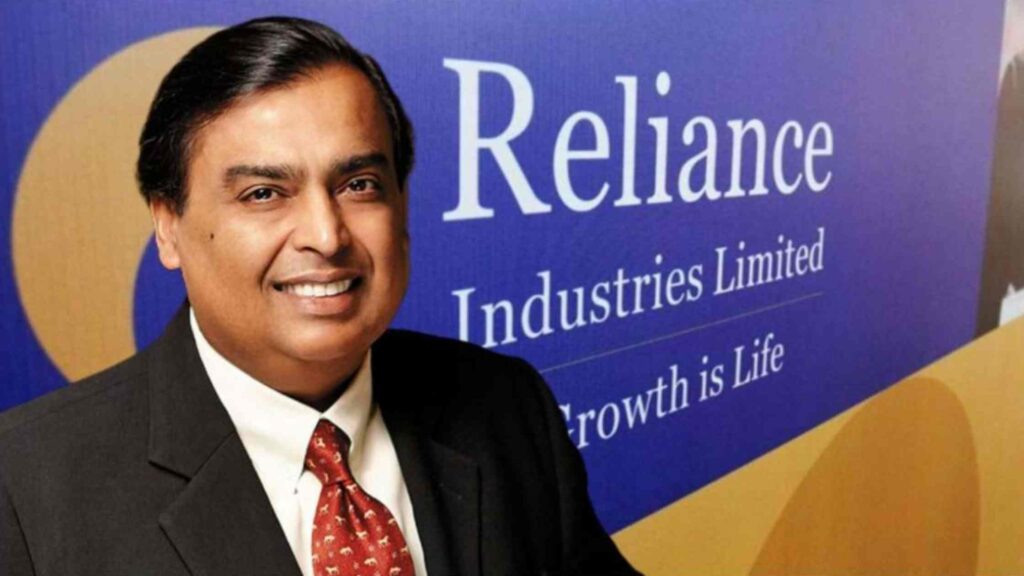

Do you know which company is the most successful Company in India?

It’s Reliance Industry which is the largest company of company India in terms of revenue and market capitalization. So Let’s start a detailed Case Study on Reliance Industry and know-how they become successful and what you can learn from them.

What’s in it for me

1. Reliance Industry Overview

So, Reliance Industry is a very prominent multi-industry company who engages in many industries such as petrochemical, textile, retail and telecommunication. Reliance Industry is the largest company of India by market capitalization and revenue.

It is also the most profitable company in India. Reliance is the biggest exporter of India who contributes 8% of the total export value of India. Government of India also earns 5% of their total income of custom and exercise from Reliance Industry.

Reliance Industry exports its goods to 108 countries. Reliance Industry ranks 106 in the fortune 500 list and 8th in the Top 250 Global Energy company. It is also the highest income tax payer in India. Reliance Industries is the first Indian company who has exceed the market capitalization of $100 Billion.

It is also the first Indian company to exceed the market capitalization of Rs 10 lakh crore. Reliance has many subsidiaries who operate in different industries.

2. How Reliance Industry Started

Reliance Industry is started by formation of Reliance Commercial Corporation. In 1973, Dhirubhai Ambani changed the name of Reliance Commercial corporation to Reliance Industries. The Early office of Reliance commercial corporation was set up at Narsinatha Street in Masjid Bunder.

It was a 350 square ft room with one telephone, one table and three chairs. Dhirubhai Ambani borrowed heavily amount to start his business. He set up her first mil in Naroda, Ahmedabad which was her life’s biggest struggle.

He launched his own brand called Vimal who sells polyester material for saris, shawls, suits and dresses. Another mill owner opposing the Sales of Vimal and said that it is a polyester brand, but Dhirubhai Ambani is a Highly motivated person.

They never stopped there and they went straight to the retailer and asked them to sell only Vimal brand. Dhirubhai Ambani marketed their brand very well. In a few days, Vimal makes a household name in the Indian textile industry. They began selling franchise outlets in which only Vimal brands are sold.

In the mid of 1970, Reliance’s turnover crossed 70 crores. Vimal is not only famous in India, but it is also famous outside India. He used advanced technology in his factories to produce more at a cheap cost. In 1975, A team from the World Bank visited the Reliance textile manufacturing Unit. He raised more money by issuing 6 series of convertible debentures.

In 1980, the Indian Government opened Polyester Filament Yarn (PFY). Dhirubhai Ambani applied for a PFY license. At that time, it was very difficult to obtain a license to run big manufacturing business and Reliance industry facing tough competition from its competitor Birla and Tata, but despite all struggle, he obtained the licence of PFY.

He pulled his eldest son Mukesh Ambani from Stanford University where he studied MBA to help him in his business. His son, left his university and came to India to help his father in the business.

At that time Ambani’s son was very young, he did not have any experience in the business. He focused on backward integration to grow his business, and so that he expanded his business to polyester fibre and petrochemical to make yarns.

In Reliance Industry Mukeh Ambani works under Rasikbhai who is executive director of the company. In 1985 Rasikbhai passed away and in 1986 Dhirubhai Ambani suffered a stroke. All the responsibility of Reliance Industry came to his son’s Mukes Ambani and Anil Ambani.

In 1991, the Hazira Manufacturing Division was commissioned as a petrochemical plant of Reliance. The company also expanded hi business in telecommunication with the tie-up from USA based firm NYNEX Corporation.

Reliance also launched a 15 kg LPG gas cylinder under the brand name reliance Gas. In 1998, the construction of Jamnagar refinery was started which is the world’s largest privately-owned Refinery. The credit of direction and lead of Jamnagar goes to his son.

In 2002, Reliance Industry discovered India’s biggest gas discovery which is the world’s largest gas discovery during that time and it was also the first discovery made by an Indian private company. In July 2006, Dhirubhai Ambani died due to a second major stroke.

Reliance Industries also expanded its business into financial service and Power business. Also, Reliance Industries purchased the majority stake of Indian Petrochemical Corporation which is India’s largest petrochemical company.

In 2004, there was a controversy between both the sons which later led to the demerger of Reliance industry. In 2005, Kokilaben Ambani, their mother, distributed the Reliance Empower into their two Sons.

Also, In this blog, we will talk about the Reliance Industry which is led by Ambani’s son. If you want to know more about Anil Ambani and their business you can read our other blog. In 2006, Reliance Industry entered into the Retail business under the brand name of reliance fresh.

By the end of 2008, 600 stores of Reliance fresh opened across the 57 cities in India. In 2010, Reliance Industry acquired Infotel Broadband Services Limited to launch his own 4G Internet Service and call service.

Later they launched his own Company named it Reliance Jio to provide internet and calling service. We will talk more about his company and their other business further. So this is the Journey of Reliance Empower.

3. Business Model of Reliance Industry

Reliance Industry runs several businesses and every business has its own business & revenue model. Here we will discuss the business model and revenue model of its major business.

Refining Business

Reliance’s core business is refining business. Reliance buys crude oil from overseas markets and then refine them in their refineries and produce petroleum products.

After the Refining, Reliance sells these petroleum products in the Indian and overseas market. Reliance mostly exports its petroleum products to other countries. Most of the revenue of Reliance Industry comes from Refined Petroleum products.

Petrochemicals

Reliance’s second major business is Petrochemicals and the second major source of its revenue is petrochemical. So, Reliance produces and markets petrochemical products like Olefins and Aromatics which is used to make detergent and plastic.

Reliance Retail

Meanwhile, Reliance Retail is another core business of the reliance industry. Also, it is the first Indian retail company whose revenue is more than 100000 crore. reliance owns a retail chain under the brand name of Reliance fresh where they sell Reliance and other company’s products.

Reliance Jio

The other core business of reliance is JIo which is an India’s no. 1 telecommunication brand. Reliance Jio’s business model is very simple. They have their own network system and they sell tariff plans. Jio runs his business own cost leadership model, thus jio priced its tariff plan very cheap. Jio makes profit by selling tariff plans in large volumes. This is the strategy that makes reliance Industry.

Other Sources

There is a lot of another source where the revenue of reliance industries come from. Reliance Industry owns Network 18 Group which is a media company. Reliance Also owns Mumbai Indian which is an IPL Franchises Team. So there are a lot of sources that contribute to the revenue of Reliance Industry.

4. How much Reliance Industry Earns

Reliance is one of the most profitable companies in India. As per the Quarter 4 result of the financial year 2019-2020, Reliance Industry made a net profit of 6575 crores. According to Forbes Reliance Industry made a profit of 36075 crores in the year 2019 which is the second-highest in India after Indian Oil Corporation. As per the Source, Mr. Mukesh Ambani earns ₹57,69,230.77 per day.

| Net Sales/Income from operations | 136,240.00 Crore |

| P/L Before Tax | 9,252.00 Crore |

| Tax | 2,677.00 Crore |

| Net Profit/(Loss) For the Period | 6,575.00 Crore |

5. Management Team of Reliance Industry

As you know Reliance Industries is one of the most successful companies in the world, but Do you know what makes Reliance Industries So Successful?

Who is Behind the Success of Reliance Industry? It’s his founder Dhirubhai Ambani and his sons . Mukesh Ambani is the current CEO of Reliance Industries. Anil Ambani is separated from Reliance Industry after the demerger of Reliance Industry, but before the demerger, he had played many important roles in the Success of Reliance Industries. So let’s talk about all of them in detail.

Dhirubhai Ambani

Dhirubhai Ambani is the founder of Reliance Empower. The Government of India also honoured him posthumously with Padma Vibhushan for his contribution in trade and business of India. Mukesh was born on 28 December 1932 in Chorwad, Junagadh District of Gujarat. He had completed his study from Bahadur Kanji school. His father named Hirachand Gordhanbhai Ambani is a local School teacher.

At the age of 17, he had migrated to Aden along with his brother. In Aden, Yaman he had worked as an accountant for the company A. Besse and Co. and he had learnt financing, accounting and so many skills that are most important for the business.

There is also a famous story that Dhirubhai Ambani melt silver bullion and sell them as pure silver because pure silver has more worth as compared to silver bullion. In Yaman his first son, Mr.Mukesh Ambani was born and later in 1959, his second son Anil Ambani was born.

After saving enough from his job, he returned to India to start his own business in the textile industry. In India, Dhirubhai Ambani started his company named Majin in partnership with his cousin brother. Maji’s main business is importing Polyester from Yemen and export spices to Yemen.

So, in due course of time, Dhirubhai Ambani has some conflict with cousin brother and both of them separated. In 1966, Dhirubhai Ambani formed Reliance Commercial Corporation. In 1986, due to suffering from stroke, he hand over his business to their son Anil Ambani and his other son Mukesh Ambani. Due to Major stroke in 2002, he was admitted to Breach Candy Hospital in Mumbai. He passed away on 6 July 2002 due to a second major stroke.

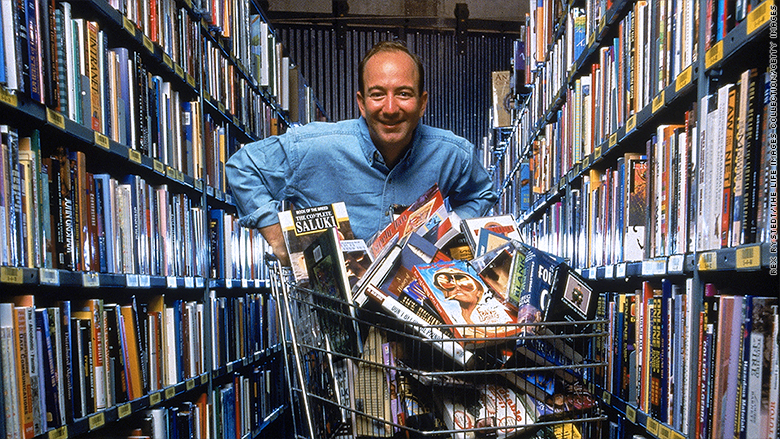

Mr. Mukesh Ambani

Also, Mukesh Ambani is now Chairman, Managing Director and largest stakeholder of Reliance Industry. Mukesh Ambani is the second richest person in Asia.

He had an estimated net worth of $ 5370 Crore. So, Mukesh Ambani was born on 19 April 1957 in Aden, Yemen. He lived in 2 apartments in Bhuleshwar, Mumbai along with his family, until the 1970s.

Later, Dhirubhai Ambani bought 14 floor Sea Wind Colaba, where until recently they lived. So, Mukesh Ambani completed his schooling from Hill Grange High School. He also completed BE Degree in Chemical Engineering from National Institute of chemical engineering. Ambani also enrolled in an MBA at Stanford but he dropped out to build her father’s venture.

He expanded his father’s business in petrochemical and refining business. Ambani led and directed Jamnagar Refinery which is the world’s largest private-owned grassroots patro refinery. Now, Mukesh Ambani also launched the JIO telecommunication under the brand name JIo. Now Jio is the top telecommunication company in India with a valuation of ₹43,574.

Anil Dhirubhai Ambani

Anil Dhirubhai Ambani was born on 4 June 1959. Now he is the founder of Anil Dhirubhai Ambani Group Also known as Reliance Group.

He started Reliance Group after the demerger of Reliance Industry. Anil Ambani joined the Reliance Industry in 1983 as co-chief executive officer.

In the leadership of Anil Ambani, the Reliance Industry raised $2 BIllion from overseas investors. You can read more about Anil Ambani here.

6. Fun & Facts

| Industries | Retail, Telecommunications |

| Headquarters Regions | Asia-Pacific (APAC) |

| Founded Date | 1966 |

| Founders | Dhirubhai Ambani |

| Funding Status | IPO |

| Number of Employees | 10001+5 |

| Legal Name | Reliance Industries Limited |

| IPO Status | Public |

| Chairman | Mukesh Ambani |

7. Digital Links of Reliance Industry

| Website | www.ril.com |

| View on Facebook | |

| View on LinkedIn | |

| Contact Email | [email protected] |

| Phone Number | +91-22-2278 5000 |

8. Funding Raised By Reliance Industry

Reliance Industry had raised a single venture fund funding of 50 Billion on Sep 2, 2016. Company has also raised money from the IPO. IPO of Reliance Industries went public in 1977 and oversubscribed by the 7 times.

9. Popular Companies Owned by Reliance Industry

Reliance Retail

Meanwhile, It is the subsidiary of Reliance Industries founded in 2006. Even, Reliance Industry is India’s first largest Indian retail chain of India in terms of Revenue and the first Indian retail company whose had the annual revenue more than 1,00,000 crore. Hence, it owns more than 3800 stores across 750 cities.

Jio Infocomm Limited

It is also known as Jio is India’s no.1 telecommunication company in terms of the customer base. Reliance Jio launched its services on 5 September. In 2019, Jio becomes India’s largest mobile network operator and the third-largest network operator in the world in terms of subscribers. Jio also launched Jio Fiber to offer broadband and television services. Mukesh Ambani announced plans to make Reliance company debt-free till March 2021.

Let’s discuss it in detail:

| Investors | Amount Invested | % Stake |

| 43,573.62 | 9.99% | |

| Silver Lake Partners | 5,655.75 | 1.15% |

| Vista Equity Partners | 11,367.00 | 2.32% |

| General Atlantic | 6,598.38 | 1.34% |

| KKR | 11,367.00 | 2.32% |

| Mubadala | 9,093.60 | 1.85% |

| Silver Lake Partners | 4,546.80 | 0.93% |

| Abu Dhabi Investment Authority | 5,683.50 | 1.165 |

| TGP | 4,546.80 | 0.93% |

| L Catterton | 1,894.50 | 0.39% |

| PIF | 11,367.00 | 2.32% |

| Total | 115,693.95 | 24.70% |

To achieve the target of becoming debt-free, Reliance had also issued the Rights Share at Rs. 1,257 at 1:15 share ratio. On 19 June 2020, Mukesh Ambani announced- “The company has achieved its target of becoming debt-free before March 2021 and now it is virtually debt-free.”

The Reliance Industrial Infrastructure Limited

It was incorporated in 1988 and a subsidiary of the Reliance Industry. Reliance Industrial Infrastructure Limited helps the reliance industry to build pipelines and OIl- Refinery Related constructions projects.

Network 18 Group

Network 18 Group is an Indian media and entertainment company founded by Raghav Bahlin 1993. Reliance Industry bought Network 18 Group in 2012 to integrate it with his Jio brand. Network 18 groups own very popular websites such as in.com, IBNlive.com, Moneycontrol.com, Firstpost.com, Cricketnext, Homeshop18, bookmyshow.com and Forbes India. It had 20 channels in 15 Indian languages

Also, Mumbai Indians

Here, Mumbai Indian is a franchise team of the Indian Premier League who represents Mumbai in IPL. Mumbai Indians were founded in 2008 and owned by Reliance. As of 2019, the brand value of Mumbai Indians is $115 Million. Mumbai Indians is the most successful team of IPL who have won 4 times in the Indian Premier League.

10. Companies Acquired By Reliance Industry

Reliance is a very prominent company that has acquired several companies to grow its pre-existing business. Reliance had acquired a company for vertical and horizontal integration. Here is the list of top companies acquired by Reliance Industry

| Acquiree Name | Price |

| Asteria Aerospace | 231.2 M |

| NowFloats | 1.4 B |

| Tesseract Inc. | 102.5 M |

| Fynd | $42.3 M |

| Hamleys PLC | 68 M |

| C-Square Info Solution | – |

| Grab | $25 M |

| SankhyaSutra Labs | – |

| Reverie Language Technologies | 1.9 B |

| EasyGov | – |

11. Investment by Reliance Industry

Reliance had also made 14 strategic management. Here is the list of top 10 companies in which they had invested

| Organization Name | Money Raised |

| Alok Industries | $33.9 M |

| Embibe | 900 M |

| JioSaavn | 1.4 B |

| New Emerging World of Journalism | $1.7 M |

| Loktra | – |

| VAKT Holdings Limited | $5M |

| JioSaavn | 140 M |

| Genesis Colors | – |

| Embibe | $180 M |

| Eros International | – |

12. SWOT Analysis of Reliance Industry

Strength

- It is the largest company in India by revenue and market capitalization.

- It has a strong brand name in the market.

- Reliance Industry had a strong financial position.

- The company operates in many industries such as textile, petrochemical, telecommunication, and retail.

- This Company has a strong return on capital expenditure.

- It had a strong market position many of its businesses are leading in their category.

- Also, it owns Jamnagar Refinery which is the world’s largest private oil refining company.

- It owns retail businesses which had a strong distribution network.

- Reliance Industries owns Reliance Jio which is India’s biggest telecommunication company.

Weakness

- Reliance Industry is subjected due to various legal procedures. Sometimes it had to pay a hefty penalty to the government.

- Reliance had invested very less in Research & Development.

- Reliance Industries had weak financial ratios.

Opportunities

- It can open more plants

- Reliance Industry can invest in the international oil and petrol destinations

- Jio can launch new offer to its customers

- It can expand its business in more emerging industries.

Threats

- Intense Competition in retail and telecommunication.

- Government Regulation and strict guidelines can interpret operations

13. Future Plan of Reliance Industry

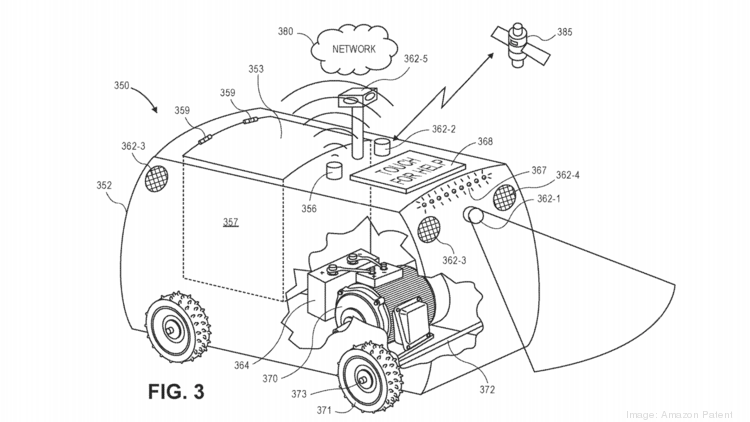

- Reliance Industry is Planning to Introduce its own E-Commerce Giant, Jio Mart. Jio Mart is now delivering essential goods in some cities of India.

- It is planning to become a debt-free company in the next 18 months.

- Reliance is partnering with Some International leaders to expand its telecommunications and retail business.

- It is planning to create an ecosystem in small merchants by creating a Point of Sale (POS) Solution – Jio Prime Partner POS.

- Also, it is planning to launch the JIO Fiber commercial very soon.

- Reliance’ Jio Microsoft joint venture planning to open a world-class data center in India powered by Microsoft’s Azure cloud platform.

14. Marketing Mix & Promotional Startegy

There are 4 P’s of marketing namely, Product, Place, Price, and Promotion. Let’s see how Reliance is following this.

Products Strategy

As we all know there that Reliance Industries recently became the first Indian company to cross 6 trillion market capitalization. They provide several products like in the retail sector are Reliance Fresh, Big Bazaar, Reliance Mart, Reliance Market, Reliance Home Kitchen, Reliance iStore.

Whereas in production they have Reliance on Solar. Reliance Life Sciences which is involved in Medical, Plant, and biotechnology, and Reliance logistics which is involved in transportation, distribution, logistics, supply chain-related activities, and telemetry solutions.

As we all know there that Reliance Industries recently became the first Indian company to cross 6 trillion market capitalization.

Place Strategy

So, Reliance Industries has a presence in almost every part of India and it is the largest retailer with 10000+ stores. Reliance Jio has good connectivity across India and in other countries too.

It is planning to create local e-commerce through JIO MART and started taking orders through using WhatsApp, started their services in Mumbai, Maharashtra.

Price Strategy

Reliance uses a different strategy for different sectors, hence the pricing strategy is so diverse, as every sector has different competition, market strategy, and pricing.

But taking Jio as an example, they provided free calling and internet for the new users and offered the sim for free, just to penetrate the market.

Promotion Strategy

Reliance uses aggressive brand promotion strategy and they have a tagline “Growth is Life”.

The reliance industry owns an IPL team, so Mumbai Indians which helps Reliance in bringing itself in limelight. They also endorse their brand through Bollywood actors like Shahrukh Khan, Hritik Roshan, and Amitabh Bachchan.

15. Frequently Asked Questions

Reliance Industries started with trading spices and later it diversified in many areas like energy, petrochemicals, textiles, natural resources, retail, and telecommunications.

Reliance Industries was started in 1966 by Dhirubhai Ambani as Reliance Commercial Corporation. Later on 08 May 1973, it renamed to Reliance industries and entered many areas like petrochemical, power-sector, telecommunication, e-commerce, etc.

There are almost 100 subsidiaries of Reliance Industries. Some major subsidiaries are:

Reliance Jio Infocomm Limited

Reliance Retail

Reliance Petroleum

Radisys

/cdn.vox-cdn.com/uploads/chorus_image/image/60014691/image.0.png)